Your Employer's Retirement Plan Benefits

Your employer's retirement savings plan is an excellent tool to help you build up your retirement savings…one piece at a time.

The Many Advantages of Your Employer's Plan

Your employer's plan provides the convenience of payroll deductions. And it offers tax benefits, which may lower your current income taxes. Equally important, you are in control - you decide in which of the plan's many investment options to place your contributions. And some plans may even include employer matching contributions.

Convenience

When you save through your plan, you don't have to remind yourself to save, because your contributions are automatically deducted from your paycheck. It's a way for you to pay yourself first, rather than trying to find "extra" money to invest for retirement - after you have paid all of your other bills.Tax Benefits

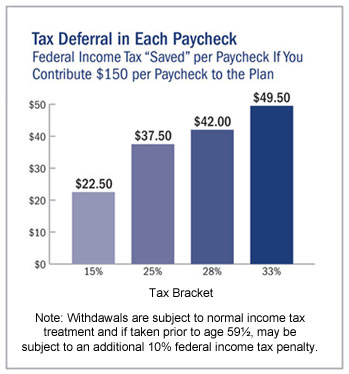

When you save on a pre-tax basis, contributions are deducted from your pay before income taxes are calculated. This means you pay less in current income taxes when you make pre-tax contributions.

When you save on a pre-tax basis, contributions are deducted from your pay before income taxes are calculated. This means you pay less in current income taxes when you make pre-tax contributions.Keep in mind, however, that you will have to pay income tax on those pre-tax contributions and any earnings when you withdrawal them from the plan. You might also incur a 10% federal income tax penalty if you withdrawal funds from a 403(b) or 401(a) account, or from amounts rolled over to a 457(b) plan from non-457(b) plans, before age 59½.

Some 403(b) and 457(b) plans also include a Roth after-tax contribution feature. These contributions offer the potential for tax-free distributions of contributions and earnings.

Employer Matching Contributions

Many retirement savings plans match employee contributions, up to a certain amount. It's like getting "free" money and can help your account grow. So if your employer's retirement savings plan offers matching contributions, try to contribute at least enough to receive the full employer match.Control of Your Assets

Most employer retirement savings plans offer a variety of investment options to choose from - and you can change your investment mix as your needs change.Access to Your Money

Depending on the provisions of your employer's plan, you may be able to take a loan from your account. Many plans also permit withdrawals for a financial emergency.Learn more about accessing your money.